Foreign Estate Fee On Maryland Property

ATTENTION ALL NON-MARYLAND RESIDENTS OWNING REAL PROPERTY IN MARYLAND:

If you are a non-Maryland resident who owns real property in Maryland, your Estate may be subject to a 1% Foreign Estate Fee that came into effect in 2022. If you own real property in Maryland in your name alone (not in Trust or other entity) and you are not a Maryland resident, at the time of your passing, your Personal Representative must make certain filings in Maryland as a “foreign personal representative” to have the authority to sell or distribute the Maryland property. The Foreign Personal Representative/Executor must report the asset, publish notice in the local paper, pay any inheritance tax owed if the property passes to a non-lineal heir or other non-exempt person, and must also now pay a fee of 1% of the gross value of the total real property in Maryland to the Maryland Register of Wills. This may amount to a significant and unexpected expense that could have been avoided through estate planning mechanisms during your lifetime.

For example, if Miriam owns property in Maryland in her name alone and dies as a Florida resident, her Personal Representative appointed in Florida must file a Foreign Estate proceeding in Maryland to have the authority to sign a Maryland deed to sell or transfer the real property to Miriam’s heirs. If Miriam’s Maryland real property is valued at $500,000 on the date of her passing with a $300,000 mortgage balance, the foreign personal representative must pay a fee of $5,000 to the Register of Wills in Maryland to open a Maryland Foreign Estate, in addition to the cost of publication of notice in the local paper and any inheritance tax owed. Without paying the 1% fee, the property cannot be transferred or sold. If Miriam owned more than one piece of real property in Maryland, in multiple counties, her personal representative must pay for publication of notice in each county, and her Estate would be subject to pay a 1% fee on the total value of all Maryland real property.

There are multiple ways to avoid the foreign personal representative requirements and paying this 1% Foreign Estate Fee at death for non-Maryland residents, if estate planning mechanisms are utilized during your lifetime. Solutions may include (1) transferring Maryland real property into a Revocable Trust; (2) creating an LLC to hold the real property; or (3) executing a Life Estate deed. Please note, however, that this would avoid the 1% Foreign Estate Fee and publication of notice, but inheritance tax must still be paid for distributions of assets to non-lineal heirs or other non-exempt individuals.

For more information about how best to avoid the 1% Foreign Estate Fee for your Maryland real property if you are presently a non-Maryland resident or contemplating moving outside of Maryland, please contact Bagley & Rhody.

DOMESTIC PARTNER INHERITANCE TAX UPDATE

DOMESTIC PARTNER INHERITANCE TAX UPDATE CODE, EST. & TRUSTS § 2-214(g)(1)

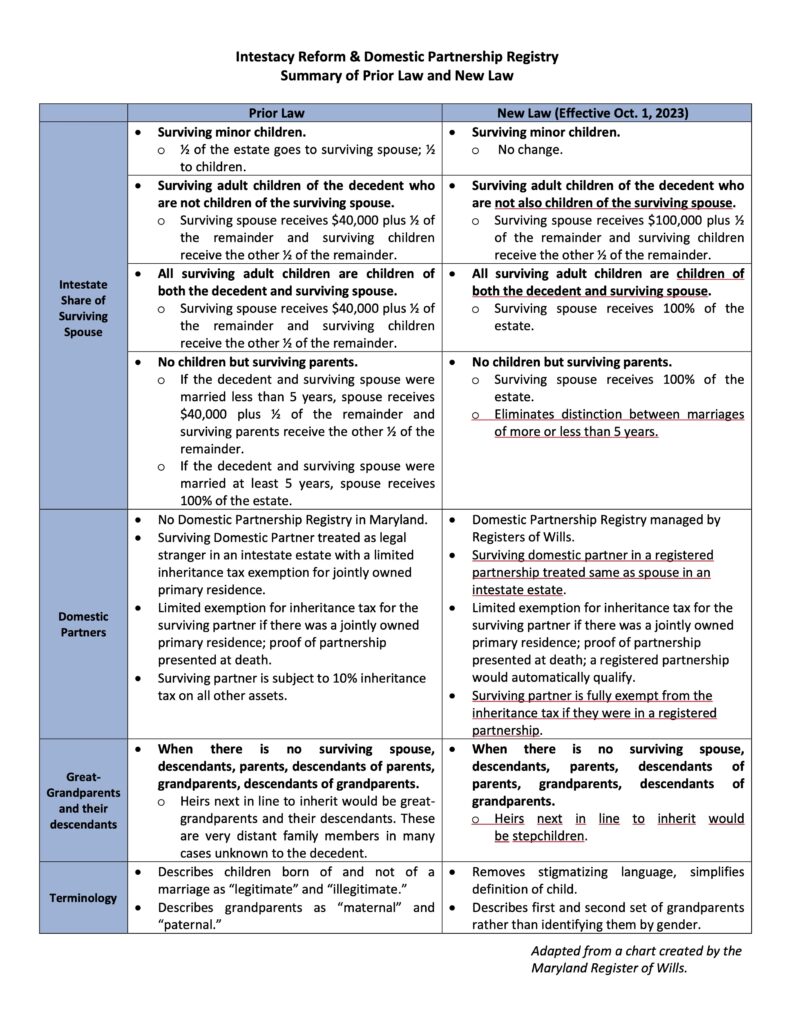

In the past, unmarried couples (domestic partners) in Maryland were affected by a specific tax called the Maryland Inheritance Tax. Since the individuals were not legally married, they did not qualify for the inheritance tax exemption, thus subjecting the surviving partner to a 10% inheritance tax upon receiving inherited assets (both by testamentary disposition and by transfer via joint ownership).

Effective as of October 1, 2023, Maryland domestic partners have a statutory avenue to avoid being subject to inheritance tax. The new law creates a Domestic Partnership Registry with each county’s Register of Wills. In the context of estate planning, when planning for unmarried couples who reside in the state of Maryland, you should consider filing a Declaration of Domestic Partnership with their county’s Register of Wills.

To the extent a Declaration of Domestic Partnership is properly registered with the Register of Wills, then a surviving domestic partner is entitled to the following benefits upon the first partner’s death:

Md. Code, Est. & Trusts § 2-214(g)(1)

(i) The share of a surviving spouse or surviving registered domestic partner of an intestate decedent;

(ii) The family allowance for a surviving spouse or surviving registered domestic partner of an intestate decedent;

(iii) Priority of appointment as the personal representative for a surviving spouse, surviving registered domestic partner, and children of an intestate decedent; and

(iv) Exemption from inheritance tax.

In cases where domestic partners have not submitted the declaration, there is still the limited exemption from inheritance tax for the surviving partner as it relates to a jointly owned primary residence with rights of survivorship. To take advantage of this limited exemption on the primary residence, certain proof of partnership must be presented.

Please note, this new law does not provide a surviving domestic partner with a spousal elective share.

Matthew Ballard Celebrates 20 Years

In the Spring of 2003, heading into the summer between my 2nd and 3rd year of law school, I applied for an estates and trusts litigation law clerk position at a small firm in Annapolis Maryland. I met with the firm’s partners, John Rhody and Charlie Bagley, in 2003 for my interview. My parents happened to be in Maryland visiting me from South Carolina that week and drove with me, thinking we would go have lunch and look around Annapolis after the interview. As it turned out, Charlie and John had their own plans of taking me to lunch at Killarney House for my interview. Not wanting to say no, I ran out to tell my parents who insisted it was ok and that they would just wait in the car as I went to lunch with Charlie and John.

After we had finished lunch, I finally admitted to Charlie and John that my parents were with me and had hung out in the car the entire time. John and Charlie couldn’t believe I didn’t tell them beforehand and felt awful that they sat in the parking lot while we enjoyed a long lunch. We parked the car, and they immediately walked over, introduced themselves and apologized to my parents for my making them wait in the car so long. It was as if they had known me and my parents for years, not hours/minutes. Their endearing personalities, personal touch, and laid-back interview process stood out from the other firms to which I had applied and interviewed.

Charlie was looking for a “right hand man” to mentor and help him with estate litigation and I had recently clerked for the Baltimore County Orphans’ Court. Thankfully, neither of them asked if I wanted to be a litigator, as I would have more than likely answered “no” at that time. They offered me the position and I started my journey at Bagley & Rhody on June 18, 2003. It turned out to be one of the best decisions in my life and the fit of the firm and practice areas turned out to be ideal as I can’t imagine not litigating, especially counter-balanced with the (generally) non-adversarial estate/trust administration.

I remained with the firm and after passing the bar exam, I joined B&R as an associate in January 2004. For years after law school, I would occasionally meet up with classmates, many of whom did not like their current jobs, and I would think to myself how lucky I was to enjoy what I do and the people that I work with. That sentiment remains the same 20 years later. It is truly an honor and a privilege to come into the office and work with our team and clients every day.

Welcome New Partners To The Firm

Bagley & Rhody, P.C. is pleased to announce the promotion of Jon F. Watson, Esquire and Brittney A. Grizzanti, Esquire, as partners to the firm effective as of January 1, 2023. Jon and Brittney’s exceptional legal skills and commitment to delivering outstanding results for their clients have made each a valuable member of the B&R team.

Jon joined the firm as an associate in 2015, and currently serves as head of the firm’s Business Department where he represents small to middle market business owners with a variety of different matters including, formation and operational matters, succession planning, and mergers and acquisitions (both buyers and sellers). Jon’s experience with the firm is not just limited to corporate law, having also gained experience in estate planning and wealth preservation for high net-worth clients to ensure consistency between a client’s individual and business planning needs. Jon’s broad range of experience and practical approach to problem solving has allowed him to facilitate even the most complex transactions, leading to his recognition as a Super Lawyer “Rising Star” in the area of mergers and acquisitions.

Jon earned his Bachelor of Science in Business degree in 2009 from Virginia Tech, where he graduated Cum Laude, majoring in Accounting and Information Systems. In 2013, he graduated from the University of Maryland School of Law with a Business Law concentration. During his time at Maryland Law, Jon also obtained his license as a Certified Public Accountant (since inactive). After graduating from law school, Jon was an associate at a public accounting firm for several years where he gained experience in tax and corporate compliance matters.

“I am thrilled to join the B&R partnership,” Jon said. “B&R is a special place, and I am grateful for the opportunity to continue working with such a talented and dedicated team of legal professionals. Throughout my time at the firm, I have been driven by a commitment to providing the highest quality legal services to our clients, and am thrilled to have the chance to continue this work as a partner. I look forward to contributing to the continued growth and success of the firm, and to serving our clients with distinction.” — Jon

Brittney joined B&R in 2016, and currently heads up the firm’s Estate Planning Department where she works directly with clients and their families to establish individualized estate plans. In her practice, Brittney handles a variety of client needs, ranging from clients who are looking to establish a simple estate plan for the first time, to clients with more complex needs, such as probate avoidance, estate and gift tax planning, business succession planning for estates containing closely held businesses, charitable planning and planning for individuals with special needs.

Born and raised in Northeastern Pennsylvania, Brittney obtained her Bachelor of Arts in English Literature from Wilkes University in 2013. She then moved to Baltimore, Maryland to pursue law school where she went on to graduate Cum Laude from University of Baltimore School of Law in 2017. During her time in law school, Brittney chose to concentrate on estate planning by serving as a research assistant to Professor Angela Vallario, focusing on the Spousal Elective Share in Maryland, as well as working full-time at B&R. Since becoming an attorney with the firm, Brittney has been recognized by Maryland Super Lawyers as a “Rising Star” in 2022 and 2023 for estate planning.

“I am excited and proud to transition to my new role as partner at B&R. The firm is a special place that I consider myself very lucky to have found so early in my career. Having joined B&R while still in law school, I have had the unique opportunity to build long-standing relationships with my clients, all while learning and growing my practice with the unwavering support and encouragement from everyone here – I could not have asked for a better team of people to work with if I tried. I look forward to continuing to provide our clients with exceptional service and helping our team at B&R continue to grow.” – Brittney

Make sure you tell Brittney and Jon “Congratulations!” next time you talk to them!